Small businesses in London understand the value of every pound saved and hour saved is invaluable to their operations. While traditional accounting methods may seem efficient at first, they can quickly become costly, time-consuming, and rigid in practice. Online accounting services have transformed business lives for startups and small enterprises seeking flexibility, accuracy, and low costs in today's fast-paced technological business world.

Read in 5 minutes

As we transition into the digital age, the way businesses manage their finances is evolving rapidly. By 2025, UK business owners will face stricter financial rules, increased competition, and heightened pressure to remain lean and efficient.

Read in 5 minutes

We enter the year 2025, and the accounting industry is being transformed by digital technology, automation, and new business demands. Face-to-face interactions are being replaced by online accounts that can deliver services remotely with the help of cloud software and digital communications.

Read in 5 minutes

For most UK business owners, the end of the financial year isn’t something to look forward to. No matter how organised you try to be, there’s usually a last minute rush to get everything in order. Invoices need to be checked, receipts must be uploaded, figures have to be reconciled, and HMRC has to receive documents on time to avoid penalties. It’s a stressful process and, quite honestly, most owners would rather focus on growing their business than dealing with spreadsheets and checklists.

Read in 5 minutes

In the fast-paced world of modern business, managing your finances efficiently is no longer optional, it's essential. Whether you’re a sole trader, a growing small business, or a limited company director, having an accountant who understands your needs is a game changer. And thanks to technology, you no longer need to limit yourself to a traditional, local accountant who requires in-person meetings and endless paperwork.

Read in 5 minutes

In today’s digital era, businesses and individuals across the UK are shifting from traditional accounting methods to more efficient, cloud-based solutions. If you're considering making the switch from a local accountant to an online accountant, you're not alone. Thousands are discovering the benefits of having their finances handled virtually with faster communication, reduced paperwork, and cost-effective solutions.

Read in 5 minutes

Freelancing in the UK has grown massively in the last decade. With increased independence comes the need for greater financial management. From submitting annual tax returns to managing invoices and expenses, the life of a freelancer involves more than just doing the work it means being your own finance department. Fortunately, today’s freelancers can take advantage of online accountant services that simplify, automate, and manage these tasks with ease.

Read in 5 minutes

In today’s fast-paced digital world, the landscape of accounting is transforming faster than ever. The traditional image of accountants buried in paperwork is being replaced by dynamic professionals who operate entirely online. Enter the online accountant, a role that has emerged as a cornerstone in modern business operations. Whether you’re a small business owner, a freelancer, or a director of a limited company, the rise of the online accountant marks a significant step forward in how we manage finances.

Read in 5 minutes

Managing your taxes in the UK can be stressful, especially when it comes to self assessment. Whether you're self-employed, a company director, or earning income from property or investments, navigating HMRC’s rules can be tricky. Fortunately, a reliable online accountant makes the entire process much easier. These experts help with every step, from gathering your financial data to filing your self assessment tax return accurately and on time.

Read in 5 minutes

In the evolving business world of 2025, small businesses are expected to adapt faster than ever before. One of the most valuable shifts in recent years is the transition from traditional accounting to a smarter, more efficient approach: online accounting.

Read in 5 minutes

Choosing the right accountant can make or break your financial peace of mind. For UK business owners, the decision between hiring an online accountant or going the traditional route isn’t always clear. Both offer value but which one suits your situation?

Read in 5 minutes

Managing business finances can quickly become a challenge, especially when tax season approaches or your daily operations get busier. Whether you're a startup, a sole trader, or a limited company director, staying on top of your books is critical. This is where having an online accountant can make a real difference.Rather than handling everything on your own or relying on outdated manual systems, many UK businesses are now switching to digital solutions. Trusted firms like Affotax have made professional, reliable, and efficient online accounting services easily accessible across the country.

Read in 5 minutes

In recent years, the way we work has changed dramatically. Across the UK, thousands of professionals have stepped away from traditional jobs to explore self-employment, freelancing, and contract work. This shift has brought independence, flexibility, and creativity into the working lives of many. But it has also introduced new challenges particularly around managing finances, filing taxes, and staying compliant with HMRC regulations.

Read in 5 minutes

Tax season can be a stressful time for individuals and business owners alike. Whether you’re a sole trader, a limited company director, or a freelancer, preparing your documents, understanding deadlines, and ensuring compliance with HMRC regulations can feel overwhelming. Fortunately, with the rise of online accountants in the UK, managing your tax obligations has never been easier.

Read in 5 minutes

Hiring an online accountant can be a smart move, especially for UK-based businesses seeking flexibility, convenience, and cost-effectiveness. With digital tools and cloud-based systems, online accounting services help you stay on top of your finances in real time. However, working with the wrong accountant or working the wrong way can lead to mistakes that cost you time, money, and peace of mind.

Read in 5 minutes

VAT (Value Added Tax) is an essential part of running a business in the UK, and it can often become a time-consuming and complex task. If you're not a finance expert, staying compliant with HMRC regulations while also running a business can feel overwhelming. This is where an online accountant becomes invaluable. With technology and cloud based systems, businesses now have access to qualified online accountants UK who can streamline VAT processes and offer peace of mind.

Read in 5 minutes

One of the most vital elements of final accounts and company for any startup is bookkeeping. It keeps your finances in order, ensures tax compliance and data accuracy, and provides insights into your business’s financial health. With the rise of digital services, many entrepreneurs now opt for an online accountant to simplify and automate this process.

Read in 5 minutes

A small UK-based nonprofit working to support mental health in rural communities. They’re passionate and driven but overwhelmed by paperwork, unclear tax responsibilities, and financial reports that don’t make sense. Sound familiar?

Read in 5 minutes

In today's fast-paced digital age, businesses in the UK are rapidly turning to online accountants to streamline their financial processes. Traditional bookkeeping methods are no longer efficient for modern businesses that need accurate, real-time, and accessible financial data. Whether you are a sole trader, a freelancer, or own a limited company, working with an online accountant UK can transform the way you manage your financial reporting.

Read in 5 minutes

In today's fast-paced digital economy, more UK businesses are moving their financial operations online. One significant shift is the growing reliance on an online accountant to manage tax preparation, bookkeeping, and compliance. From startups to well-established limited companies, the trend towards online accounting services is proving beneficial on multiple levels. With convenience, cost savings, and better access to real-time data, the question is no longer "Why switch?" but rather "Why haven’t you switched yet?"

Read in 5 minutes

With the surge in remote working across the UK, businesses are facing a new challenge how to manage payroll effectively without traditional office systems. This transformation has highlighted the growing importance of hiring an online accountant to manage finances, especially payroll, in a seamless, digital-first manner.

Read in 5 minutes

In the UK’s rapidly evolving business environment, growth and scalability are no longer solely dependent on sales and marketing strategies. Financial management plays a crucial role in sustainable business expansion and this is where an online accountant becomes a vital asset.

Read in 5 minutes

Online accounting has reshaped how businesses manage finances in the digital age. With cloud-based software and expert services, managing accounts, filing taxes, and staying compliant with HMRC is now faster and easier than ever. At Affotax, a trusted online accountant UK, we believe in combining innovative accounting technology with professional support.

Read in 5 minutes

In today’s tech-driven world, businesses and individuals in the UK are increasingly turning to online accountants for their financial needs. The demand for online accounting services has soared in recent years, thanks to the convenience, cost savings, and efficiency these services offer.

However, one of the most important things to understand before hiring an online accountant is how they charge for their services. Pricing models can vary significantly depending on the provider, the complexity of the work, and your business structure whether you’re self employed or running a limited company.

Read in 5 minutes

Launching a startup in the UK is thrilling, but it comes with its fair share of financial complexities. From managing budgets and tracking expenses to ensuring timely tax returns and staying compliant, startups face challenges that require more than just good intentions they need expertise. That’s where an online accountant becomes an essential ally.

Read in 5 minutes

As digital solutions become more prominent in the UK business landscape, traditional accounting methods are giving way to smarter, faster, and more efficient online alternatives. Hiring an online accountant is now a popular choice for sole traders, freelancers, startups, and even limited companies.

Read in 5 minutes

Freelancing has become one of the most popular career choices in the UK. From writers and designers to consultants and developers, more people are choosing the freedom of self-employment. But with freedom comes responsibility especially when it comes to finances. That’s where an online accountant steps in.

Read in 5 minutes

In today’s digital age, managing your finances no longer requires frequent visits to an office or hours spent on paperwork. More individuals and businesses are now opting to work with an online accountant a professional who can manage your accounts, taxes, and compliance requirements entirely through digital platforms.

Read in 5 minutes

The digital age has transformed every aspect of running a business including how financial records are kept and analysed. For small businesses in the UK, adapting to this change can be the key to growth and sustainability. One of the most impactful decisions a small business owner can make is hiring an online accountant.

Read in 5 minutes

Tax season in the UK can be overwhelming, especially for small businesses, limited companies, and freelancers. Managing deadlines, forms, and compliance with HMRC requirements can feel like a full-time job. Thankfully, an online accountant can make this entire process faster, easier, and more accurate. With advancements in online accounting services, UK taxpayers now have access to professional tax support without leaving their home or office.

Read in 5 minutes

Choosing the right online accountant in the UK is crucial for your business's financial health. With so many options available, how do you determine which accountant is the best fit for your specific needs? At Affotax, we understand the challenges that small businesses, freelancers, and limited companies face when managing their accounts remotely. That’s why we’ve put together this comprehensive guide to help you ask the right questions before hiring an online accountant.

Read in 5 minutes

In the rapidly evolving world of finance and business, the accounting landscape in the United Kingdom is experiencing a significant shift. The traditional image of accountants poring over stacks of paperwork in dimly lit offices is fading fast. In its place, a new digital model is emerging online accountants.

Read in 5 minutes

In today's digital world, managing your business finances doesn't need to be a complicated or overwhelming task. Finding the right online accountant can streamline your financial operations, ensure compliance with tax laws, and ultimately help your business grow. If you run a small business or a startup, hiring a professional online accountant could be a game changer.

Read in 5 minutes

In today’s fast-paced business world, time and money are two of the most valuable resources for any entrepreneur. Whether you run a startup, a small business, or a growing enterprise, managing your finances efficiently is key to success. This is where an online accountant can make a world of difference.

Read in 5 minutes

In today’s fast paced business environment, technology continues to redefine how entrepreneurs and companies manage their finances. One of the most notable shifts is the rise of online accountants in the UK. As businesses strive to remain agile, efficient, and compliant with evolving regulations, online accounting services are becoming the preferred alternative to traditional accounting.

Read in 5 minutes

In today’s fast moving digital economy, UK businesses are shifting towards more efficient and smarter financial management solutions. One of the most significant changes has been the adoption of online accounting. Whether you're a freelancer, sole trader, startup, or a limited company, hiring an online accountant is no longer just an option, it's a business necessity. With the help of online accountant UK professionals, companies are streamlining operations, staying compliant, and saving valuable time and money.

Read in 5 minutes

Submitting your tax return for Self Assessment can often feel like a massive weight lifted off your shoulders—until the wait begins. When will HMRC process it? Has it gone through correctly? These are questions many of us have, especially when running small businesses or managing self-employment. Knowing the status of your submitted tax return isn’t just about peace of mind; it’s essential for avoiding penalties and handling tax payments or refunds promptly.

Read in 5 minutes -rEPy3Q2REDJ7pCvlFhIeLoBtuV1XmU.png&w=1080&q=75)

Starting a business involves countless decisions, but one of the most crucial is choosing the right legal structure. Should you become a sole trader, or is a private limited company a better fit for your goals? This decision carries significant implications, impacting everything from taxation to liability.

Read in 5 minutes %252019-yQSmeMjpgULUNosxPkPssmrelWdYPV.png&w=1080&q=75)

VAT—a topic that strikes fear into the hearts of many sole traders and freelancers. It’s surrounded by confusion, endless rules, and paperwork that most people would rather avoid. But ignoring VAT isn’t an option. For self-employed individuals operating in the UK, understanding and managing VAT is essential for staying compliant and keeping your business on the right track.

Read in 5 minutes -opWTAL844Yqgj0khGJEttp9vDedVkm.png&w=1080&q=75)

Tax season can feel daunting for sole traders. Filing a tax return, navigating deadlines, and waiting for refunds can add to the stress of running your business. Questions like "How long does a tax return take?", "How long for a tax refund to arrive?", and "Do I even need to complete a Self Assessment tax return?" often come to mind during this time.

Read in 5 minutes

Managing your business finances is never easy, especially when it comes to navigating tax obligations. For UK business owners, corporation tax can be a significant expense. However, with the right strategies, you can reduce your tax bill legally while staying compliant with HMRC regulations.

Read in 5 minutes -nJoZUF0UNnNloZE1YQ6dAo5lanTeSB.png&w=1080&q=75)

For small business owners, entrepreneurs, and accountants alike, staying on top of financial obligations is critical—not just for your business's health, but for avoiding some serious penalties too. One such obligation? Filing your accounts with Companies House on time.

Read in 5 minutes

Running a small business, working as a freelancer, or managing entrepreneurial ventures has its rewards—but it also comes with its fair share of challenges, especially when it comes to managing finances. For many self-employed individuals, an accountant is much more than someone who files taxes once a year. They serve as critical partners for navigating the often-confusing landscape of business finances and tax obligations.

Read in 5 minutes -Hye1en5zwMcoD9AX8F1dBRdfVQ7jhz.png&w=1080&q=75)

One of the most tax-efficient ways for limited company directors and shareholders to get income is through dividends. Since dividends are paid from a company's post-tax profits rather than salaries, which are subject to PAYE tax and National Insurance contributions, many business owners prefer them.

Read in 5 minutes -ttOchnYGccasO75mXHUbzdVaM99AZZ.png&w=1080&q=75)

The introduction of Making Tax Digital for Income Tax Self-Assessment (MTD ITSA) marks another major shift in how businesses and individuals manage their taxes. For accountants, businesses, and sole traders not currently using accounting software, this transition can feel overwhelming. But fear not—while MTD ITSA compliance may seem daunting, it is completely manageable with the right preparation and guidance.

Read in 5 minutes -LyFbr6hkq9GAPCofgXyxJ8MYapVdi5.png&w=1080&q=75)

Navigating the world of taxable income can feel overwhelming, especially if you’re a freelancer, small business owner, or anyone managing their own taxes. But here’s the deal—understanding how taxable income works is crucial to ensuring you don’t overpay (or underpay!) come tax season.

Read in 5 minutes -QN381ArOqxuTVHELJDEHdaFcd5CGBf.png&w=1080&q=75)

Whether you're running a small business or managing a larger enterprise, an annual report is more than just a legal or accounting obligation—it's a vital tool for understanding your performance, communicating with stakeholders, and driving future growth. If you’re overlooking this document, you’re likely missing out on some valuable strategic insights and benefits.

Read in 5 minutes

Starting a business in the UK as a non-resident might seem like a daunting task, but the process is easier than you think. With a streamlined registration system and no residency barriers, non-UK residents are flocking to take advantage of the opportunities provided by one of the most business-friendly environments in the world.

Read in 5 minutes -WqmsRhqJaN3jxVAGfXJoqQDf94KV64.png&w=1080&q=75)

Are you ready to bring your business idea to life? Starting a limited company in the UK offers structure, liability protection, and credibility. Whether you’re a solo entrepreneur or a small business owner, company formation might feel like a daunting task—but it doesn’t have to be.

Read in 5 minutes -8tVRymajSPnhO3JUSAd3tkNR314GOi.png&w=1080&q=75)

Bookkeeping is essential for small businesses to stay organized and compliant. With the rise of digital solutions, Xero stands out as an efficient, cloud-based tool for managing finances. Whether you’re new to bookkeeping or upgrading your methods, Xero streamlines tasks like invoicing, transactions, and reconciliations, helping you stay on top of your financial health effortlessly.

Read in 5 minutes

Filing your self-assessment tax return can be overwhelming, but with proper guidance and preparation, it becomes an easy and efficient process. In this guide, we’ll walk you through everything you need to know to ensure your return is filed correctly and on time.

Read in 5 minutes -PRvALXv0dDtFrYpUJvaaa1rYnVEWjg.png&w=1080&q=75)

Closing a business involves careful planning and tough decisions, whether due to financial struggles, a pivot, or a desire to move on. The key choice is whether to dissolve the company, liquidate assets, or both. Let’s explore your options to determine the best path forward for your business closure.

Read in 5 minutes

Annual accounts are crucial for assessing a company’s financial health. However, hidden risks like reporting errors, non-compliance, and poor cash flow management can lead to severe consequences. Understanding and addressing these risks is essential to maintaining financial security and business stability. Discover key dangers and strategies for safeguarding your accounts.

Read in 5 minutes -AQBVRIlMDEfRksXwaG1vihE1dqb0mg.png&w=1080&q=75)

In today’s fast-paced business world, managing your finances can be overwhelming. Without an efficient and reliable bookkeeping system, your business could be facing hidden dangers that may compromise its long-term success. The importance of professional bookkeeping services cannot be overstated. This article will explore how working with a professional bookkeeper can protect your business, streamline your financial operations, and ensure compliance with tax regulations.

Read in 5 minutes

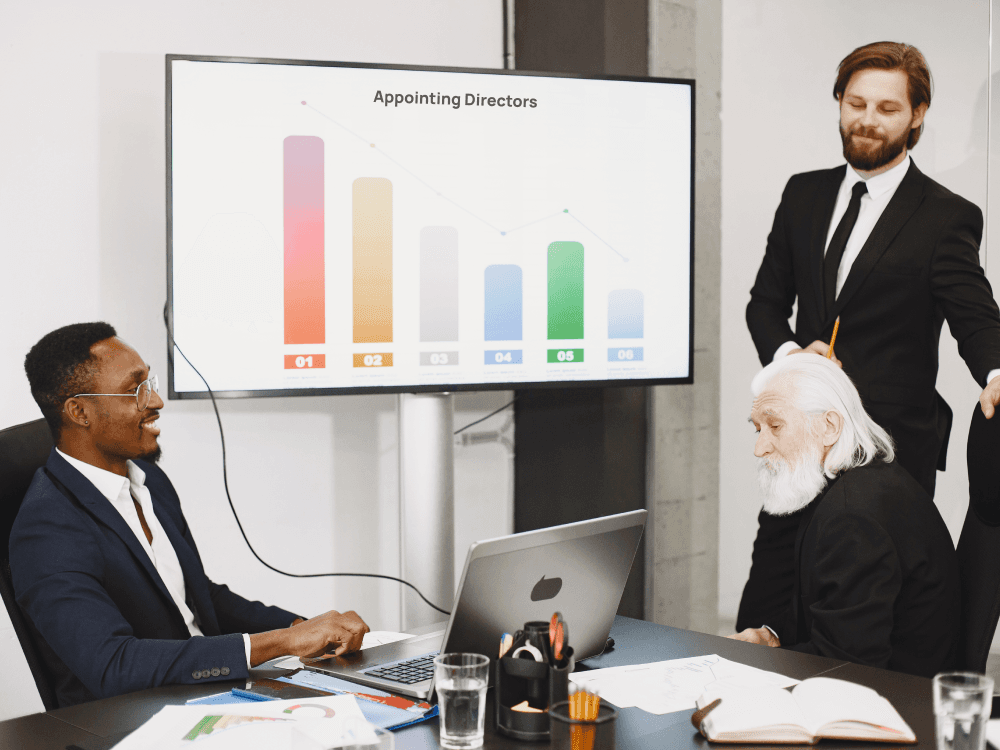

Starting and managing a business involves many responsibilities, including appointing directors. Directors play a key role in shaping strategy, overseeing management, and ensuring legal compliance. A company can have individual directors or a corporate director—a business entity. This guide covers the process, legalities, and responsibilities of appointing a corporate director in a limited company.

Read in 5 minutes

This comprehensive guide explains the process of resigning as a director, including the legal requirements, necessary forms like the TM01 form, and the implications of resignation. It covers key steps, such as notifying Companies House and updating company records, and offers expert advice for a smooth, legally compliant resignation process.

Read in 5 minutes

Learn how to sell shares in the UK with our step-by-step guide. Discover the best platforms, costs, tax implications, and strategies for making informed decisions. Whether you're reaching investment goals, cutting losses, or balancing your portfolio, this guide helps you navigate share selling efficiently and safely.

Read in 5 minutes -GgsCJVyxH9UEcBrKCXf75iIPeLmprf.png&w=1080&q=75)

Changing the name of a limited company in the UK involves legal steps, including passing a resolution, updating legal documents, and notifying authorities. This article covers the key requirements, benefits, and the process of changing your business name to ensure compliance with UK company laws and regulations.

Read in 5 minutes

In this article, we’ll dive into the methods available for paying yourself as a director, compare the pros and cons of each, and explore tax-efficient strategies. Whether you're considering PAYE, dividends, or a combination of both, we'll cover everything you need to know.

Read in 5 minutes

Moving to a new address? Learn why updating your address with HMRC is crucial for avoiding penalties, ensuring accurate tax filings, and staying compliant, especially for Self-Assessment tax returns. This guide covers everything you need to know, including a step-by-step process to notify HMRC and how it impacts your tax obligations.

Read in 5 minutes

Registering for self-assessment is a vital step for anyone earning income not taxed at source in the UK. Whether you’re self-employed, a landlord, a company director, or someone with untaxed earnings, understanding the registration process ensures compliance with HMRC requirements. This guide covers all aspects of self-assessment registration, explains the processes for different circumstances, and provides insights not covered in other resources.

Read in 5 minutes

Managing self-assessment tax can be challenging, particularly for self-employed individuals or those with multiple income sources. This guide simplifies the process, covering all necessary topics, clarifying common pain points, and offering unique insights to help you confidently calculate and manage your tax obligations.

Read in 5 minutes

Every limited company in the UK is legally required to file annual accounts with Companies House. Whether you’re a small business, a micro-entity, or even a dormant company, you need to follow certain steps to ensure your accounts are filed accurately and on time. In this guide, we’ll break down when and how to file, common pitfalls to avoid, and tips to make the process smoother.

Read in 5 minutes -NxY15aHC2jqW0V9cvTFB2SGADNuIAD.png&w=1080&q=75)

Forming a company in the UK can be a rewarding yet complex journey, with various steps that need to be completed to ensure legal compliance and operational readiness. This guide aims to simplify the process, helping you to understand the key stages and decisions involved in setting up a company, from choosing a structure to filing the necessary documentation. Here’s a clear, step-by-step approach to forming a company in the UK, covering details often overlooked in competitor guides.

Read in 5 minutes

When starting or restructuring a business, selecting the right legal structure is one of the most critical decisions you’ll make. Among the various structures available, the limited company model stands out due to its unique advantages. However, it also comes with its set of challenges. In this comprehensive guide, we’ll explore the advantages and disadvantages of operating as a limited company, compare it with the sole trader model, and provide insights to help you make an informed decision.

Read in 5 minutes

The United Kingdom remains an attractive destination for international professionals, offering a wealth of opportunities across industries. However, the legal framework governing employment requires both employees and employers to ensure compliance with immigration laws. One key element in this process is the right to work share code—a digital tool designed to streamline the verification of an individual's eligibility to work in the UK.

Read in 5 minutes -py4Tjb4kjAXVGfXLwBCrc1EUGbC89u.png&w=1080&q=75)

In today’s fast-paced business landscape, efficient payroll management is essential but often challenging. Payroll involves numerous processes, including calculating wages, handling deductions, and staying compliant with complex and ever-evolving regulations. For UK businesses, these complexities are heightened by the need to comply with HMRC (Her Majesty’s Revenue and Customs) standards, manage PAYE (Pay As You Earn) schemes, and adhere to the General Data Protection Regulation (GDPR) for data privacy.

Read in 5 minutes -Lnd9K7V17Qg3fof2piyOKFYfIwoEuj.png&w=1080&q=75)

Understanding the various taxes applicable in the UK can feel overwhelming, but having a clear view can help you plan and manage your finances effectively. In this comprehensive guide, we’ll explore the main types of taxes you might encounter, including direct taxes like Income Tax and Capital Gains Tax, as well as indirect taxes like VAT and Stamp Duty. This guide also covers important tax nuances for business owners, expats, and those seeking efficient tax planning.

Read in 5 minutes -OucNjtpOUq70zPdbxle5F810sNv5ke.png&w=1080&q=75)

Navigating tax deadlines can be challenging, especially as regulations evolve and the pressure to remain compliant grows. For taxpayers in the UK, whether individuals or business owners, understanding the key deadlines for the 2024 tax year can help prevent unnecessary stress and avoidable penalties. In this comprehensive guide, we outline crucial tax dates, penalties for late submissions, and insights on effective tax management.

Read in 5 minutes

Maintaining a dormant company in the UK can offer strategic benefits like cost savings, reduced compliance requirements, and brand protection. However, understanding how to file dormant company accounts and ensuring compliance with Companies House and HMRC regulations is critical. This comprehensive guide will cover all aspects of dormant company accounts, including definitions, filing requirements, practical steps, common pitfalls, and strategic advantages.

Read in 5 minutes

Company dissolution, also known as "striking off," refers to the formal closure of a company and its removal from the Companies House register. Once dissolved, the company ceases to exist as a legal entity and cannot carry out any business activities. This guide will provide a detailed overview of what company dissolution entails, why it might be necessary, and how to navigate the process effectively.

Read in 5 minutes

Filing LLP accounts with Companies House is essential for UK LLPs, as it ensures legal compliance and avoids costly penalties. This blog post will guide you through the process of filing accurately and on time, while also covering the basics of Limited Liability Partnerships (LLPs) in the UK.

Read in 5 minutes

As a business owner in the UK, it’s vital to understand corporation tax. This blog covers everything you need to know, from tax rates to paying online. Read on to get a comprehensive overview and ensure your business stays compliant without any confusion.

Read in 5 minutes

Corporation tax is a tax on profits for limited companies and taxable organizations in the UK. As a business owner, it's crucial to understand how to calculate and file it. This post will guide you through corporation tax calculation, filing, and offer useful tips.

Read in 5 minutes

Congratulations on your new venture! Now that you’ve formed your UK company, it’s time to tackle an essential responsibility: registering for corporation tax. This guide will walk you through the registration process, who needs to register.

Read in 5 minutes

Your tax code ensures you pay the right amount of tax, helping you avoid surprise bills or refunds. Despite its importance, tax codes often confuse people. This article breaks down tax codes, explaining their components, how they’re calculated, and what to do if you suspect an error.

Read in 5 minutes

Navigating the UK tax system can be complex, especially for self-employed individuals or those with multiple incomes. The SA302, a key tax calculation summary, is vital for financial and administrative purposes. This guide explains the SA302's importance, what it is, and how to obtain it.

Read in 5 minutes

An SA100 is an official HMRC form for UK sole traders or business owners to report income, gains, and financial details. It’s essential for self-assessment, helping taxpayers accurately calculate their tax liability. Understanding the SA100 form is crucial before starting the filing.

Read in 5 minutes